Directory Overview

Browse 50+ strategic tax jurisdictions with detailed profiles comparing tax rates, residency costs, banking access, and lifestyle benefits. Click any country below to view the complete analysis.

Global Jurisdiction Profiles

Choosing the right jurisdiction is one of the most powerful moves a high-net-worth individual can make. This directory showcases the world’s most strategic countries for tax optimization, offshore banking, second residency, and global asset protection—so you can move with clarity, not guesswork.

Andorra

European Microstate with Low Taxes- Personal income tax capped at 10% with generous exemptions

- Attractive passive residency program for investors and retirees

- Safe, stable jurisdiction with strong banking and healthcare

Antigua & Barbuda

Caribbean Citizenship-by-Investment- Attractive citizenship-by-investment program from $100,000

- Visa-free access to 150+ countries, including the EU and UK

- Zero tax on worldwide income for non-resident citizens

Armenia

Underrated Base for Low-Cost Structuring- 1% tax regime for micro-businesses under $60,000 turnover

- Open to remote founders and digital nomads with simple setup

- Fast-growing IT hub with relaxed residency rules

Bahamas

Zero-Tax Island Jurisdiction- No personal income, capital gains, or inheritance tax for residents

- Permanent residency available via real estate investment

- Popular banking hub with strong confidentiality protections

Belize

Offshore-Friendly Commonwealth Jurisdiction- Territorial tax system—foreign income not taxed for residents

- Permanent residency via QRP program for retirees and remote earners

- Strong offshore banking tradition with USD accounts and privacy

Bermuda

Zero-Tax Island Jurisdiction- No income, wealth, or capital gains taxes

- World-class insurance, finance, and fintech sectors

- Luxury living with a stable legal and political environment

Botswana

Africa’s Most Stable Economy- Low, flat 22% corporate tax rate

- No exchange controls for offshore investments

- Highly stable democracy with strong banking confidentiality

British Virgin Islands (BVI)

Iconic Offshore Incorporation Hub- No capital gains, inheritance, gift, or sales taxes

- World-renowned for private offshore company structures

- No local corporate taxes for offshore companies

Brunei

Asia’s Hidden Zero-Tax Gem- No personal income tax for individuals

- Strong sovereign wealth backing and financial stability

- No sales taxes or VAT on domestic transactions

- Operates under Islamic law, shaping cultural and business practices

Bulgaria

EU Residency with Flat Tax System- 10% flat personal and corporate tax—lowest in the EU

- Permanent residency path available with low investment thresholds

- Ideal for EU business structuring and tax optimization

Cayman Islands

Offshore Banking Haven- Zero personal income tax, capital gains tax, and withholding taxes

- Premier banking center with strong privacy laws and asset protection

- Sophisticated trust and corporate structures with legal certainty

Cook Islands

Elite Asset Protection & Offshore Trust Jurisdiction- Globally recognized for the strongest asset protection trusts

- Favored by HNWIs for offshore wealth preservation

- No income, capital gains, or inheritance taxes

Costa Rica

Lifestyle Residency with Territorial Tax System- No tax on foreign income under territorial system

- Residency options for retirees, investors, and remote workers

- Safe and stable democracy with solid banking and legal systems

Cyprus

EU Tax Advantage Zone- Non-Domicile tax regime with exemption on foreign dividends and interest

- Citizenship-by-investment program with EU passport benefits

- Strategic holding company jurisdiction with extensive tax treaty network

Dominica

Affordable Citizenship-by-Investment Pioneer- Citizenship starting from $100,000 donation—no residency required

- Visa-free access to 140+ countries including the EU & UK

- No wealth, inheritance, or capital gains taxes

Dubai (UAE)

Business & Tax Haven- Zero personal income tax and capital gains tax regime

- Multiple residency options including the Golden Visa program

- Strategic free zone system with specialized business incentives

Estonia

EU Digital Residency Pioneer- Corporate tax only applies upon profit distribution, not reinvested earnings

- E-residency program allows full remote business setup for foreigners

- Member of EU with fast-growing fintech ecosystem

Georgia

Emerging Tax Haven- 1% micro business tax rate and special tax regimes

- Streamlined immigration system with minimal bureaucracy

- Visa-free entry for 365+ days for most nationalities

Gibraltar

UK-Linked Tax Haven with EU Access History- Maximum personal tax capped at ~£44,740 under Category 2 status

- Robust legal system and financial infrastructure backed by the UK

- Corporate tax rate fixed at 12.5%, with no capital gains tax

Greece

Golden Visa & Flat Tax for Foreign Income- Flat €100,000 annual tax on global income for non-doms (15-year regime)

- Low-cost Golden Visa with no physical presence requirement

- Access to EU residency, real estate, and lifestyle benefits

Grenada

CBI Program + Zero Tax on Foreign Income- No tax on foreign income, capital gains, or wealth

- Citizenship-by-investment program with U.S. E-2 visa access

- Popular base for second passport and tax neutrality

Hong Kong

Asian Financial Hub- Territorial tax system with no tax on foreign-sourced income

- Sophisticated banking system with strong privacy protections

- Premier business hub with simple incorporation and low compliance

Ireland

EU Corporate Tax Structuring Hub- 12.5% corporate tax on trading income—among the lowest in the EU

- Common law legal system, ideal for holding and IP companies

- Home to many multinational HQs with strong treaty network

Isle of Man

British Crown Dependency- 0% corporate tax for most businesses (except banks & land income)

- Simple residency pathway via economic self-sufficiency

- Strong regulatory environment with UK financial access

Italy

Flat Tax Program for New Residents- €100,000 flat tax on foreign income for 15 years

- Ideal for HNWIs relocating from high-tax countries

- Lump-sum regime does not trigger CFC rules

Jersey & Guernsey

Offshore Hubs with Ultra-Low Corporate Tax- 0% standard corporate tax, with some exceptions for financial services

- Well-regarded for banking, fund administration, and trust services

- Strong legal system and ties to the UK without full EU obligations

Liechtenstein

Elite Asset Protection with EEA Access- World-class jurisdiction for foundations and family asset protection

- Not part of the EU, but full EEA access via EFTA membership

- Highly secure banking environment with deep Swiss ties

Luxembourg

Wealth Structuring Hub with Strong EU Access- Premier destination for investment funds and holding structures

- Advanced legal frameworks for private wealth, funds, and family offices

- Attractive tax treaties and EU-wide passporting capabilities

Malaysia

Territorial Tax System- No tax on foreign-sourced income for residents and non-residents

- Malaysia My Second Home (MM2H) program for long-term residency

- High standard of living with significantly lower costs than Singapore

Malta

EU Tax Planning Hub- Non-Dom program with EU residency benefits

- Strategic location for EU business operations

- Extensive tax treaty network and refund system

Mauritius

Africa-Asia Financial Gateway- Partial tax exemption regime reduces effective corporate tax to 3%

- Access to over 45 tax treaties across Africa, Europe, and Asia

- Strategic location and stable jurisdiction for offshore companies

Monaco

Ultra-High-Net-Worth Residency Hub- No personal income tax for Monaco residents (except French citizens)

- Residency by establishing local presence and bank deposit (~€500,000+)

- Renowned for safety, discretion, and elite financial services

Montenegro

European Residency Path- Low personal income tax rates with 9% flat corporate tax

- Fast-track residency through real estate purchase

- EU candidate country with strategic path to EU citizenship

Netherlands

Strategic EU Base with 30% Tax Ruling Option- 30% ruling allows significant income tax reduction for expats

- Robust infrastructure, transparent legal system, and EU access

- Excellent for holding structures and EU-wide corporate access

North Macedonia

Flat Tax and Emerging Residency Base- 10% flat personal and corporate tax rate

- Low-cost EU-accessible residency through business or real estate

- Non-Schengen Balkan base with simple bureaucracy

Oman

Middle East Gateway with Quiet Tax Perks- No personal income tax and territorial corporate tax

- Investor residency with real estate and business paths

- Non-FATF graylisted, with stable regional banking

Panama

Territorial Tax System- Pure territorial tax system with no foreign income taxation

- Friendly Nations Visa for easy permanent residency

- Strong banking privacy laws and offshore structures

Paraguay

Territorial Tax with Instant Residency- 10% income tax on local income only—foreign income is exempt

- Residency granted with basic bank deposit and paperwork

- One of the easiest second residencies in the world

Portugal

European Lifestyle Haven- Modified NHR program with special tax incentives

- Golden Visa program provides EU freedom of movement

- High quality of life with affordable living costs

Romania

EU Residency with Flat Tax & Startup Edge- 10% flat income tax, 1–3% micro-company corporate tax

- Excellent remote work base with low cost of living

- EU residency and passport path over time

Seychelles

IBC Powerhouse with Tropical Lifestyle- Territorial tax for individuals; 1.5% tax for IBCs on foreign-sourced income

- Popular for offshore corporate structures and holding companies

- Residency permit available via investment and employment

Singapore

Global Business Hub- Territorial taxation with exemptions for foreign income

- Sophisticated banking system with strong asset protection

- World-class legal system with excellent asset protection

Saint Kitts & Nevis

Zero-Tax Citizenship Hub- Zero personal income, capital gains, and wealth tax

- Fast-track second passport via Citizenship by Investment

- Asset protection laws with favorable offshore structures

Spain

Beckham Law & Digital Nomad Visa- 24% flat tax on Spanish income for new residents for 6 years

- Digital Nomad Visa offers 5-year path with Beckham-like incentives

- High-quality lifestyle and EU mobility access

St. Lucia

Citizenship by Investment & Tax Simplicity- Second passport via donation or real estate from $100,000

- No tax on capital gains, wealth, inheritance, or worldwide income

- Popular CBI for Americans and crypto investors

Switzerland

Private Banking Capital- Lump sum taxation for wealthy foreigners

- World-class private banking with robust privacy laws

- Canton-specific tax incentives and holding structures

Thailand

Digital Nomad Favorite with Elite Options- Foreign income exempt if not remitted in same year

- Thailand Elite Visa offers 5–20 year residency with no tax filing

- Major global expat hub with strong lifestyle appeal

Turkey

CBI, Residency, and Investment Base- Second passport via $400K real estate investment

- Regional base for banking, property, and business structuring

- No tax on foreign-sourced income for non-residents

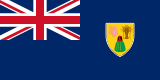

Turks and Caicos

Tax-Free British Overseas Territory- No income, capital gains, inheritance, or corporate tax

- British overseas status with legal stability and reputation

- Premier destination for lifestyle and asset protection

Uruguay

South American Haven- Territorial tax system with foreign income exemptions

- Straightforward permanent residency with minimal requirements

- Strong banking privacy and financial stability

Vanuatu

Zero Tax Citizenship & Offshore Privacy- Citizenship in 1–2 months via donation from ~$130,000

- No income, capital gains, inheritance, or wealth tax

- Offshore-friendly for trusts and foundations

Explore Our Complete Strategic Toolkit

Beyond this calculator, we offer 10+ specialized tools covering tax compliance, offshore banking, business formation, and residency planning.