Fiscal Repression Is Back: How Governments Are Quietly Draining Your Wealth — And What You Can Do About It

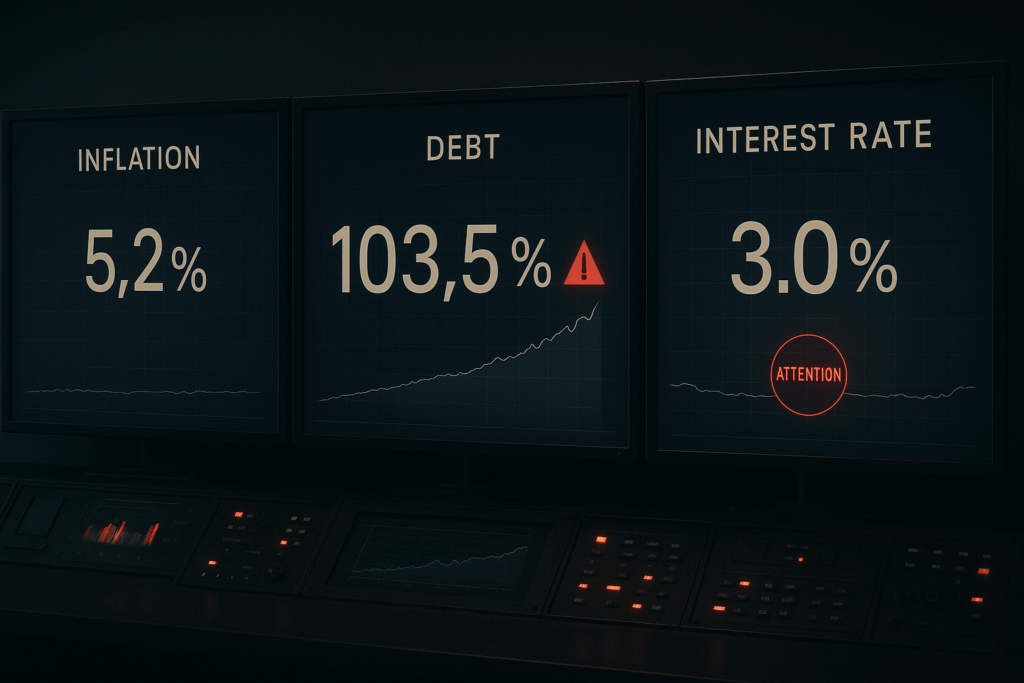

With global debt-to-GDP ratios exceeding 100%, governments are systematically transferring wealth from savers through fiscal repression. Here’s your strategic response framework for protecting assets and preserving financial freedom.

Key Takeaways

- Fiscal repression systematically transfers wealth from savers to governments through below-market interest rates and regulatory capture.

- Global debt-to-GDP ratios exceeding 100% make fiscal repression mathematically necessary for government debt reduction.

- Strategic response framework includes asset reallocation, jurisdictional diversification, and advanced protection structures.

- Legal positioning remains possible through international banking, business structures, and tax residency optimization.

This is a professional-grade optimization framework. Always consult a qualified advisor before implementation.

Fiscal Repression Is Back: How Governments Are Quietly Draining Your Wealth — And What You Can Do About It

You won’t hear it on the news. There’s no emergency law, no press conference. But slowly, silently, your financial freedom is being narrowed. When interest rates fall below inflation—as they did during the pandemic era—your savings lose purchasing power while sitting in “safe” government-backed accounts. Your pension fund is required to buy government bonds at artificially suppressed rates. Capital controls are “temporarily” expanded for national security.

This isn’t accidental—it’s fiscal repression, and it’s how governments reduce crushing debt burdens by systematically transferring wealth from savers to the state. With global debt-to-GDP ratios exceeding 100% across major economies, this quiet wealth extraction has become essential government policy.

Welcome to the new normal.

What Is Fiscal Repression?

Fiscal repression is the practice of channeling funds to government at below-market rates through regulation, taxation, and policy manipulation. Unlike direct taxation, which faces political resistance, fiscal repression operates through the financial system itself.

Fiscal Repression Risk by Nationality

Financial freedom constraints and government wealth extraction risk by passport

| Country | Risk Score | Primary Risk Factors |

|---|---|---|

| United States | 9.5/10 | FATCA, global taxation, exit tax |

| China | 9.0/10 | Capital controls, investment restrictions |

| Russia | 8.8/10 | Sanctions, banking isolation |

| Argentina | 8.2/10 | Currency controls, inflation |

| Turkey | 7.8/10 | Currency instability, gold controls |

| India | 7.5/10 | Foreign account restrictions |

| South Africa | 6.8/10 | Capital limits, currency weakness |

| France | 6.2/10 | Wealth taxes, regulation |

| Germany | 5.8/10 | Pension exposure, low yields |

| Japan | 5.5/10 | Public debt, yield suppression |

| United Kingdom | 4.8/10 | Financial surveillance, pension intervention |

| Canada | 4.2/10 | Tax compliance, banking oversight |

The Modern Government Toolkit:

- Interest rate suppression — Central banks keep rates artificially low, below natural market levels

- Forced domestic investment requirements — Banks and pension funds must hold government debt regardless of returns

- Capital controls — Restrictions on moving money internationally, limiting escape routes

- Financial surveillance expansion — Increased reporting requirements and transaction monitoring

- Currency debasement — Monetary expansion that erodes savings while reducing government debt burden

→ Quantify Your Fiscal Repression Exposure

Use our Tax Burden Comparison Calculator to measure how government policies affect your real returns across different jurisdictions.

Why It’s Back Now

The mathematics are brutal and unavoidable. Most developed nations now carry debt-to-GDP ratios exceeding 100%—levels that historically led to default or hyperinflation. The United States sits at 120%, while Japan approaches 250%. These aren’t sustainable through normal economic growth.

Governments face three options: drastically cut spending (political suicide), dramatically raise taxes (economic suicide), or quietly extract wealth through financial repression (the chosen path). Aging populations demanding benefits while productive capacity stagnates make this choice almost inevitable.

As Carmen Reinhart and Kenneth Rogoff documented in their seminal research, fiscal repression was how governments reduced massive post-WWII debt burdens. Today’s debt levels are higher, making repression not just likely—but mathematically necessary.

The Hidden Tax on Your Wealth

How It Works in Practice

Consider a hypothetical scenario common during recent economic crises: When government bonds yield 2% while inflation runs 4%, savers experience a negative real return of -2% annually. A retiree with $500,000 in “safe” treasury bonds loses $10,000 in purchasing power each year. Over a decade, that represents more than $100,000 in wealth quietly transferred to government coffers.

Who Gets Hit Hardest:

- Traditional savers and retirees in fixed income investments

- Domestic pension and insurance funds legally required to hold government debt

- Middle-class investors in regulated retirement accounts

- Anyone unable to access international alternatives

The Pension Trap

Perhaps nowhere is fiscal repression more evident than in pension fund regulations. Across developed economies, pension funds face increasingly strict requirements to hold domestic government bonds—regardless of their returns. Your retirement savings become involuntary government financing, ensuring a captive buyer base for treasury debt.

→ Offshore Banking Compliance Guide

Navigate international banking regulations while building the diversification necessary to protect against domestic fiscal policies.

This isn’t theoretical. During Europe’s sovereign debt crisis, regulations forced local banks to increase holdings of their home government’s bonds, creating the “doom loop” where banking stability became tied to government solvency.

This systematic wealth extraction is precisely why sophisticated investors use strategies covered in our Asset Protection Hub to maintain wealth outside government-controlled systems.

How Citizens Are Trapped

The Regulatory Web

Fiscal repression works because it makes alternatives difficult or illegal:

- Banking regulations require domestic institutions to hold government securities

- Capital controls restrict international investment, often introduced as “temporary” measures

- Tax penalties on foreign accounts and investments create compliance costs exceeding benefits

- Reporting requirements make offshore diversification administratively burdensome

The Surveillance Expansion

Financial privacy has eroded dramatically under the guise of anti-money laundering and tax compliance. Programs like FATCA force foreign banks to report on American citizens, while similar initiatives spread globally. This isn’t about catching criminals—it’s about preventing capital flight.

When governments can monitor every transaction, they can effectively control where citizens place their wealth.

Understanding these obligations is crucial for Americans abroad, which is why we created comprehensive resources like our US Expat Tax Risk Assessment tool.

The Strategic Response Framework

Smart wealth preservation requires moving assets outside fiscal repression’s reach while maintaining full legal compliance. This isn’t about tax evasion—it’s about strategic positioning in a changing financial landscape.

Tier 1: Immediate Repositioning (0-6 months)

- Asset Reallocation: Reduce exposure to government-controlled fixed income investments

- International Banking: Establish relationships with sound banking jurisdictions

- Productive Assets: Shift toward inflation-hedged real assets, equities, and productive investments

- Currency Diversification: Move beyond single-currency exposure

Tier 2: Jurisdictional Diversification (6-18 months)

- Tax Residency Optimization: Establish residency in territorial tax systems that don’t tax foreign-source income

- Banking Diversification: Spread assets across multiple stable jurisdictions

- Business Structure: Incorporate in business-friendly environments with favorable tax treatment

- Investment Platform Access: Gain access to international markets restricted to domestic investors

→ UAE vs Singapore: Strategic Comparison

Compare two premier business formation jurisdictions that offer alternatives to fiscally repressive domestic structures.

Tier 3: Advanced Structures (1-3 years)

- International Trusts: Asset protection structures beyond domestic government reach

- Multiple Residencies: Flexibility to adapt to changing political and economic environments

- Citizenship Planning: Second passport as ultimate insurance against government overreach

- Sophisticated Structures: Complex arrangements for ultra-high-net-worth protection

→ International Trusts & Foundations

Advanced asset protection structures that operate beyond the reach of domestic fiscal repression policies.

Assess your optimization potential with our Tax Non-Residency Assessment Tool and explore opportunities through our Jurisdiction Explorer.

Tier 4: Portfolio Hardening (Ongoing)

- Physical Assets: Precious metals and commodities outside the banking system

- Cryptocurrency Integration: Censorship-resistant digital assets where legally compliant

- Real Estate Diversification: International property in stable markets

- Alternative Investments: Private equity, collectibles, and other non-correlated assets

Implementation Timeline: Your Next Steps

Month 1: Assess your current exposure to fiscal repression using our Tax Burden Comparison Calculator to quantify the hidden costs of your current structure.

Month 2-3: Establish international banking relationships following our Offshore Banking for US Citizens Guide to ensure compliance while gaining access to global markets.

→ FEIE Strategic Guide for US Citizens

Learn how the Foreign Earned Income Exclusion provides immediate tax relief while you implement broader fiscal repression protection strategies.

Month 4-6: Research tax residency alternatives through our detailed country guides for Portugal, UAE, and Singapore to understand your options for jurisdictional optimization.

Month 7-12: Implement chosen strategies while maintaining full tax compliance using resources like our Foreign Earned Income Exclusion Calculator and FBAR Compliance Guide for US citizens abroad.

→ FBAR Compliance Assessment

Ensure full compliance with international reporting requirements as you diversify assets beyond domestic control.

Our Philosophy: Legal Strategic Positioning

We believe in legal, ethical strategic repositioning—not tax evasion or recklessness. When your home country quietly redesigns the financial rules to extract wealth from savers, you have both the right and responsibility to respond intelligently.

Fiscal repression represents a fundamental shift in the social contract between governments and citizens. While politicians promise safety and security, the reality is systematic wealth transfer from productive citizens to an ever-expanding state apparatus.

The tools for legal protection exist. The question is whether you’ll use them before the window closes further.

Fiscal repression is policy. Strategic response is prudence.

Global Strategy Framework

This content provides framework-level insights for sophisticated investors and financial professionals. While comprehensive, it requires proper professional guidance for implementation in your specific situation. All strategies must be executed in full compliance with relevant laws and regulations.

This material is for informational purposes only and does not constitute investment, legal, or tax advice. Consult qualified professionals for guidance specific to your circumstances.